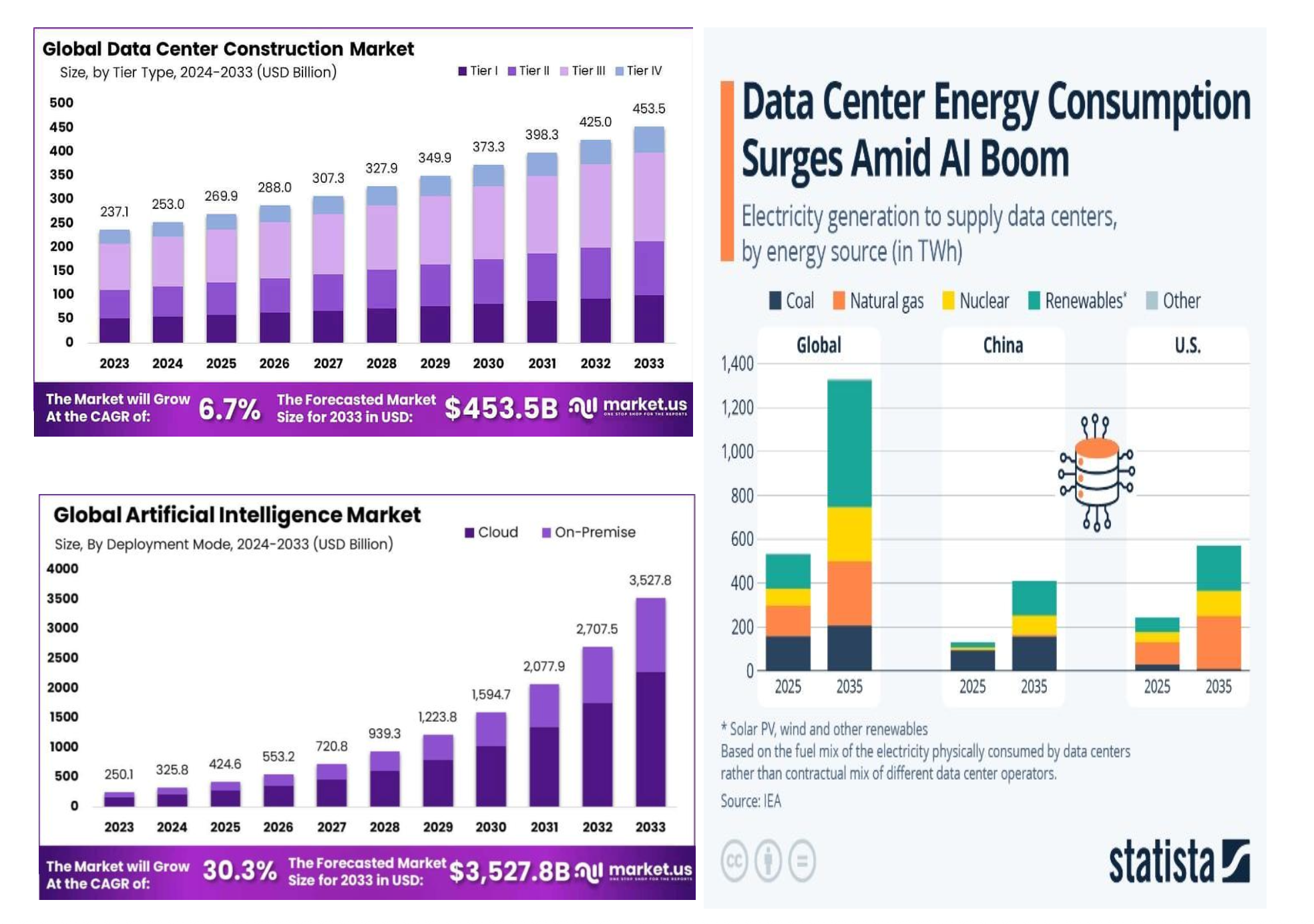

In 2025, the leading U.S. technology companies, known as the “Magnificent Seven,” have embarked on an unprecedented spending race, pouring massive investments into data centers, energy production, and infrastructure dedicated to artificial intelligence (AI). These colossal capital expenditures (CapEx) reflect their ambition to control the entire technological value chain, from energy generation and data storage to computing power.

CapEx refers to a company’s capital expenditures to acquire, maintain, or develop its long-term assets. Unlike operating expenses (OpEx), CapEx focuses on building the infrastructure of tomorrow — data centers, networks, solar farms, and server farms.

Google plans to spend $75 billion in 2025 alone, with over $17.2 billion already invested in the first quarter. The company is building massive data centers across the U.S. — in Iowa, Virginia, and Indiana — and partnering with renewable energy producers to secure its power supply.

Amazon is committing $20 billion in Pennsylvania, $13 billion in Australia, $10 billion in North Carolina, and $4 billion in Chile. The company is also betting on nuclear energy to power its servers and remains the world’s largest buyer of green electricity.

Microsoft is going even further with an $80 billion investment plan. The Redmond giant has signed deals to restart nuclear power plants, like Three Mile Island, and announced the purchase of 19 gigawatts of renewable energy — while acknowledging a 23% rise in its CO₂ emissions since 2020.

Meta Platforms (Facebook) is increasing its CapEx to $68 billion to develop massive AI superclusters like Prometheus and Hyperion. The goal is clear: to build so-called “general” AI capable of surpassing humans in many domains.

Apple plans to spend $500 billion over four years, covering AI, silicon, and a partial overhaul of its supply chain to reduce its dependence on China.

Even lesser-known players like CoreWeave are investing heavily: $6 billion in Pennsylvania alone, 32 data centers, and more than 250,000 NVIDIA GPUs in operation.

Why these staggering figures? Because today’s AI models require unprecedented computing power, constant and reliable energy, and ever-growing volumes of data. Data centers could account for up to 9% of U.S. electricity consumption by 2030. At the same time, energy sovereignty has become a strategic priority — Big Tech no longer wants to rely on states or foreign suppliers.

While these massive projects are creating thousands of skilled jobs, they also raise important environmental questions. Tech giants are trying to balance cutting-edge performance with carbon neutrality and social acceptance but they do not always succeed.

Today’s leading technology companies are not just innovating in digital services anymore. They are building the next generation of the Internet itself. This transformation is opening the door to a new era of investment opportunities that reach far beyond the traditional tech sector. Companies linked to renewable and nuclear energy, semiconductors, data infrastructure, critical materials, and cybersecurity are set to play a pivotal role in this rapidly expanding ecosystem. For savvy investors, this revolution promises multiple new sources of growth.

The already fragile balance in the Middle East was shaken this Thursday as Israel launched a major military offensive named “Strength of a Lion.” Targeted airstrikes were carried out on several key Iranian facilities, including nuclear program sites, ballistic missile factories, and sensitive military infrastructure. The Israeli operation comes amid mounting tensions with Tehran, which is accused of accelerating its nuclear ambitions.

In response, Iran promptly declared a state of emergency. Explosions were reported in the Tehran area, and Iranian authorities announced they are preparing a retaliation.

This escalation is raising serious concerns about the potential for a broader regional conflict, particularly involving key oil-producing countries in the Gulf.

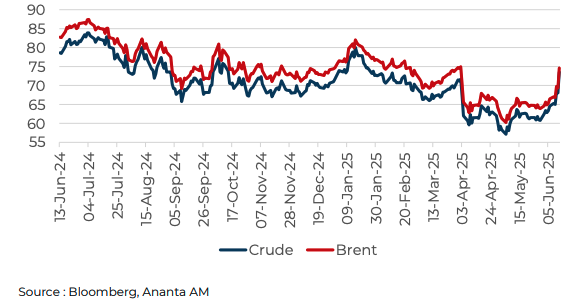

Unsurprisingly, global markets reacted with heightened anxiety. Crude oil prices surged over 10% within hours of the news, with both Brent and WTI crude breaching symbolic thresholds amid fears of a supply shock. Gold, the ultimate safe haven, soared past $3,450 an ounce, while traditional refuge currencies like the Swiss franc and Japanese yen rallied. On Wall Street, equity futures posted sharp declines as investors braced for further volatility.

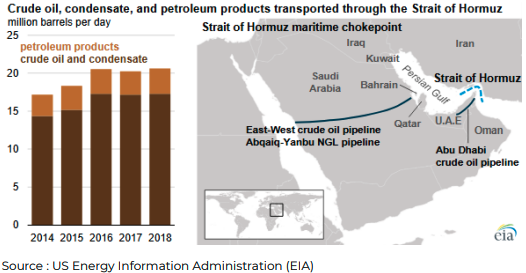

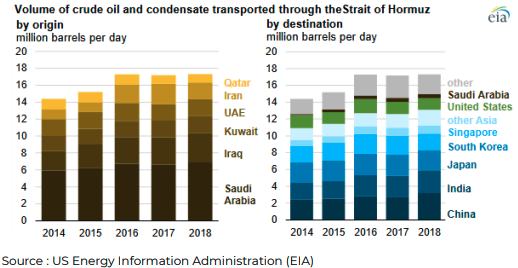

At the center of global concern lies the Strait of Hormuz — a strategic corridor through which roughly 20% of the world’s oil supply flows. This vital chokepoint is a critical artery for the global economy. Even a temporary closure would have dramatic consequences on energy prices, supply chains, and global inflation.

Historically, conflicts in the Middle East have had a massive impact on global oil supply. The 1973 Arab embargo, the 1979 Iranian Revolution, and the 1990 Gulf War each led to supply cuts ranging from 6% to 9%. A blockade of the Strait of Hormuz today could surpass these past events in both scale and duration.

On the monetary front, the consequences are already being considered. While central banks — notably the U.S. Federal Reserve and the ECB — had been anticipating rate cuts in the coming months, this spike in oil prices could shift the outlook. Renewed energy-driven inflation may force monetary authorities to keep interest rates higher for longer than previously expected.

More than just a targeted strike, the Israeli operation could mark the beginning of a new chapter of heightened geopolitical, energy, and financial volatility.

Something big is happening in Japan’s fixed income market — and global

central banks, including the Fed, are likely paying close attention.

For years, the Bank of Japan has kept a tight lid on long-term interest rates through aggressive bond purchases. As a result, it now holds over 50% of all Japanese Government Bonds which, in total, is worth more than $8 trillions worth.

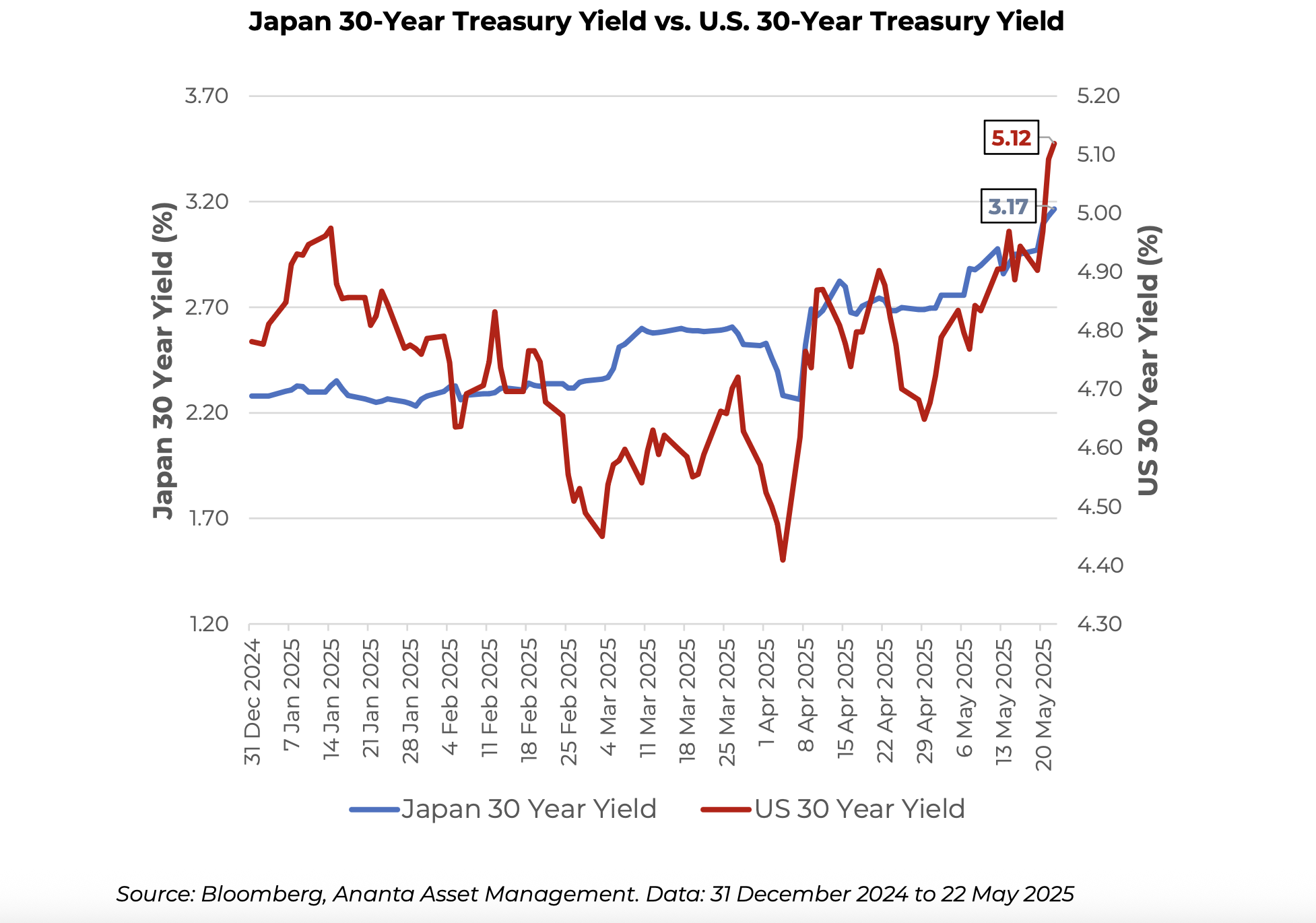

But that grip is starting to slip. Recently, yields on long-dated JGBs have started to surge, indicating growing market pressure and suggesting that the BoJ is gradually losing control over the long end of the curve.

With government debt exceeding 260% of GDP, the Bank of Japan faces a difficult policy dilemma, either tighten policy, and risk economic growth or maintain loose conditions, and risk fueling inflation and market instability.

The JGB selloff is a bigger problem for the U.S. Treasury market

As JGB yields rise, Japanese institutional investors (like insurers and pension funds) are finding domestic bonds more appealing again. This increases the risk of capital repatriation — selling foreign assets and bringing money back home.

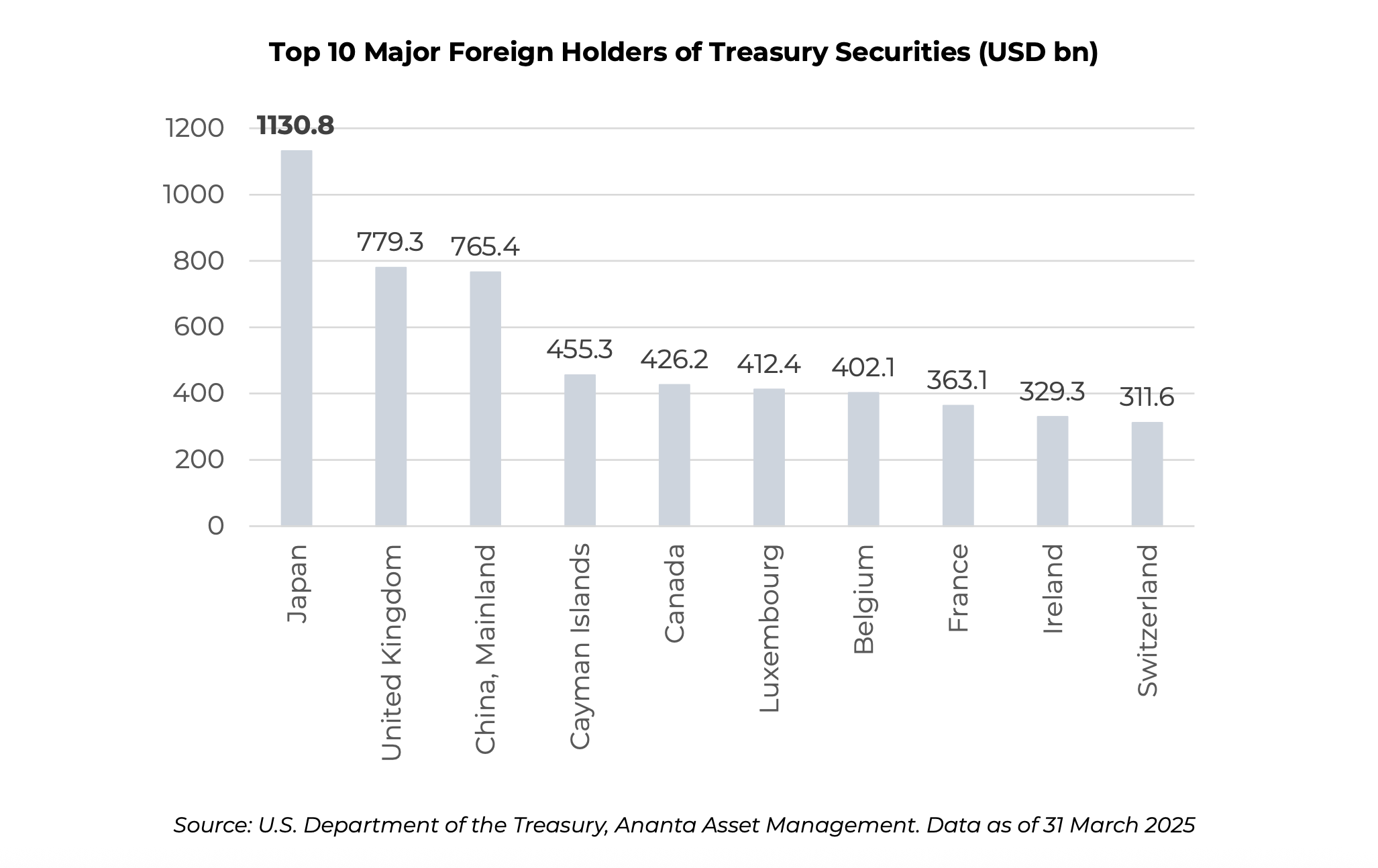

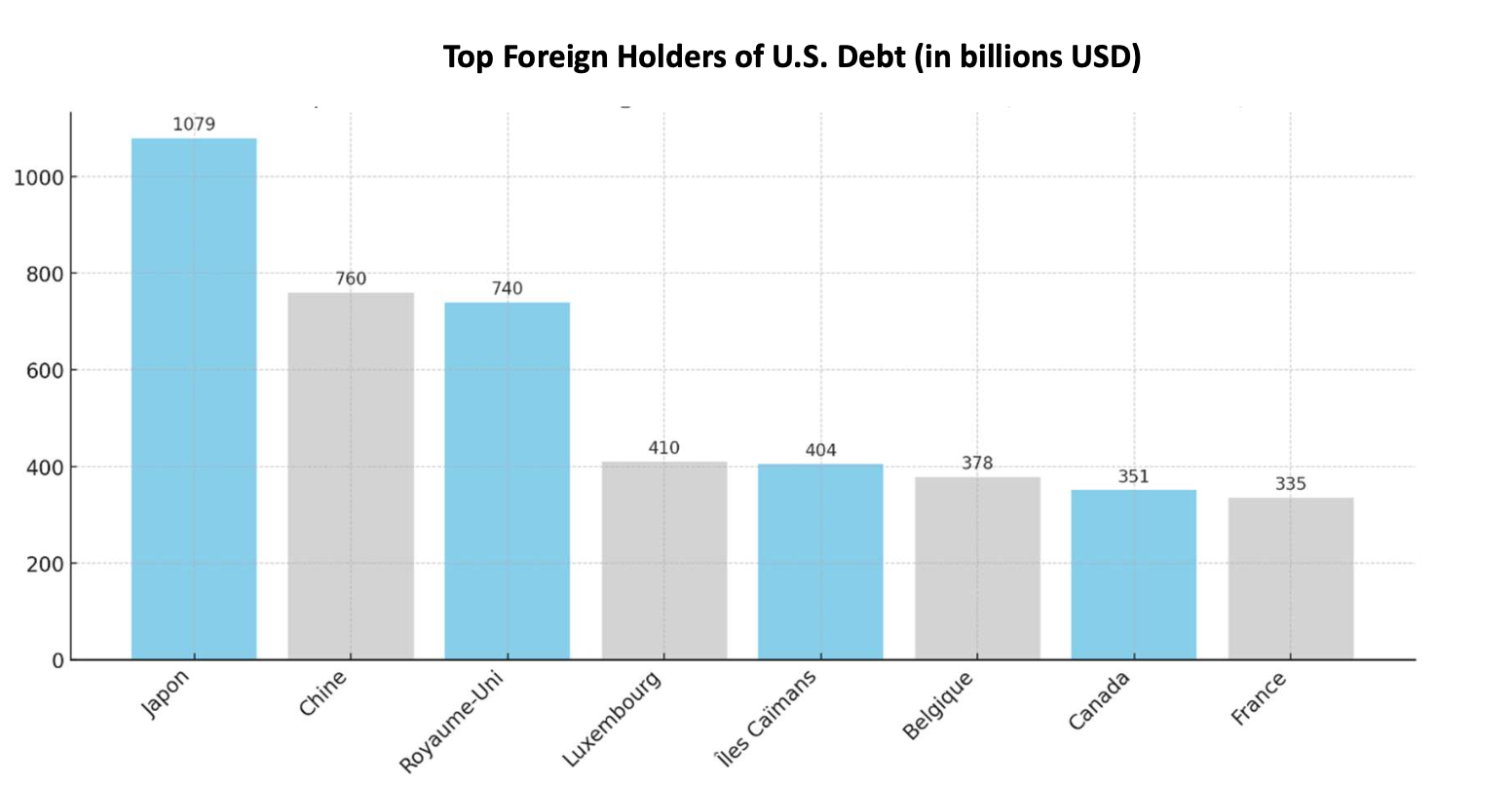

That’s significant because Japan is the largest foreign holder of U.S. Treasuries (around $1.13 trillion), which is a consequence of prolonged ultra-loose monetary policy, which pushed domestic investors to seek better yields abroad. A wave of selling could push U.S. long-term yields higher, potentially triggering a chain reaction of tighter global financial conditions.

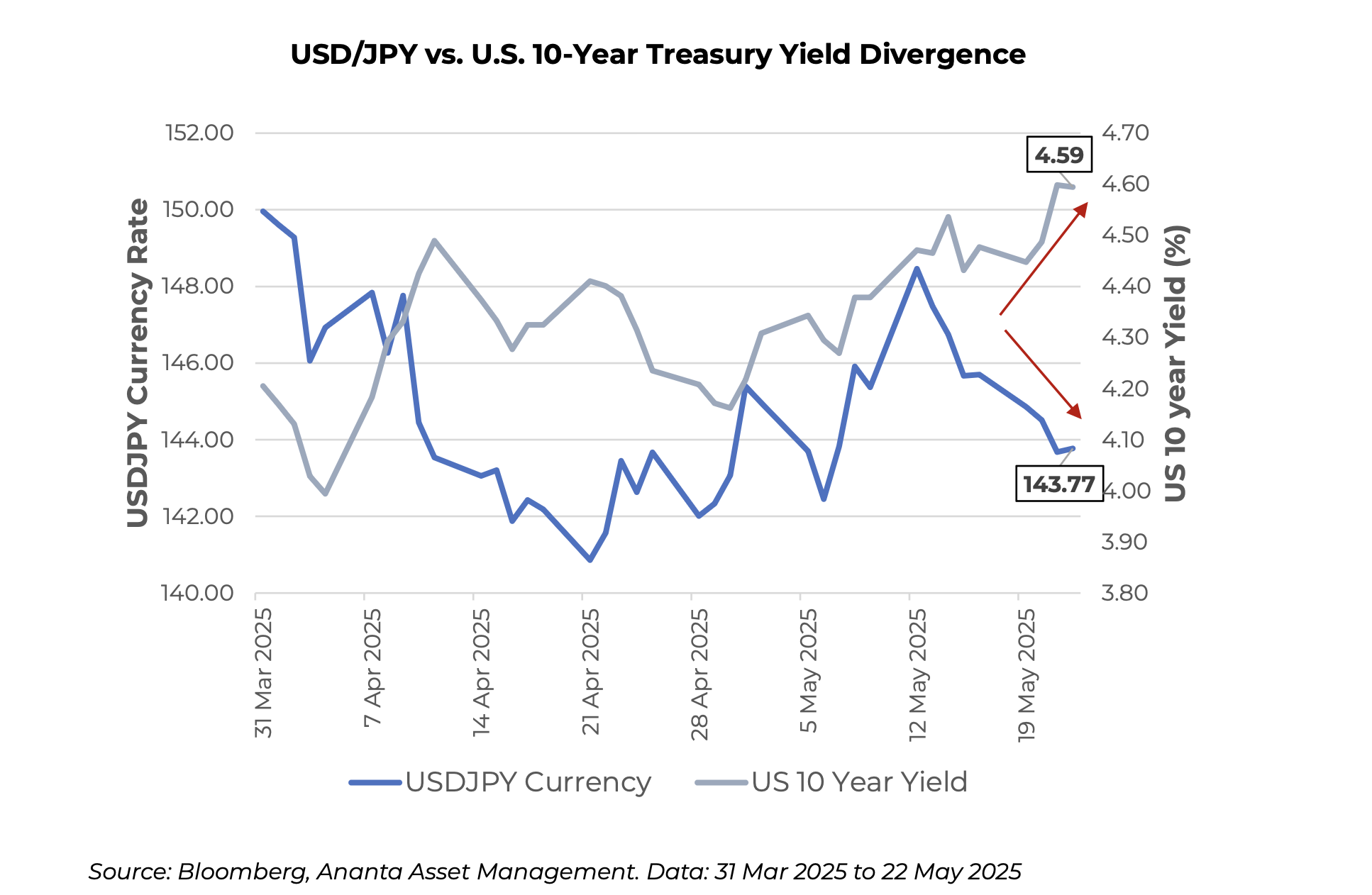

Currency Signals: Yen Strengthening as Treasury Demand Weakens

Recent trends in the USD/JPY exchange rate and U.S. yields suggest something unusual is happening. The yen is strengthening despite rising U.S. yields — a potential sign that foreign investors are reducing their participation in the U.S. Treasury market.

Weak Demand for Japanese Government Bonds – Or a Turning Point?

A recent auction of 20-year Japanese bonds saw the lowest demand in over a decade, while 30-year JGB yields recently hit their highest level since 1999 with bond yields this week reaching 3.185%. These elevated yields are now attracting international buyers and domestic institutions may follow.

This development could impact U.S. Treasuries

With Japan potentially redirecting capital back home, U.S. Treasury markets face multiple headwinds:

• Record issuance to fund fiscal deficits

• Diminishing foreign demand

• Recent ratings downgrade by Moody’s

• Political gridlock over spending cuts

The latest U.S. Treasury auction took place on Wednesday, May 21, 2025, involving 20-year bonds worth $16 billion. The issuance attracted moderate demand, reflecting investor concerns about the U.S. fiscal situation.

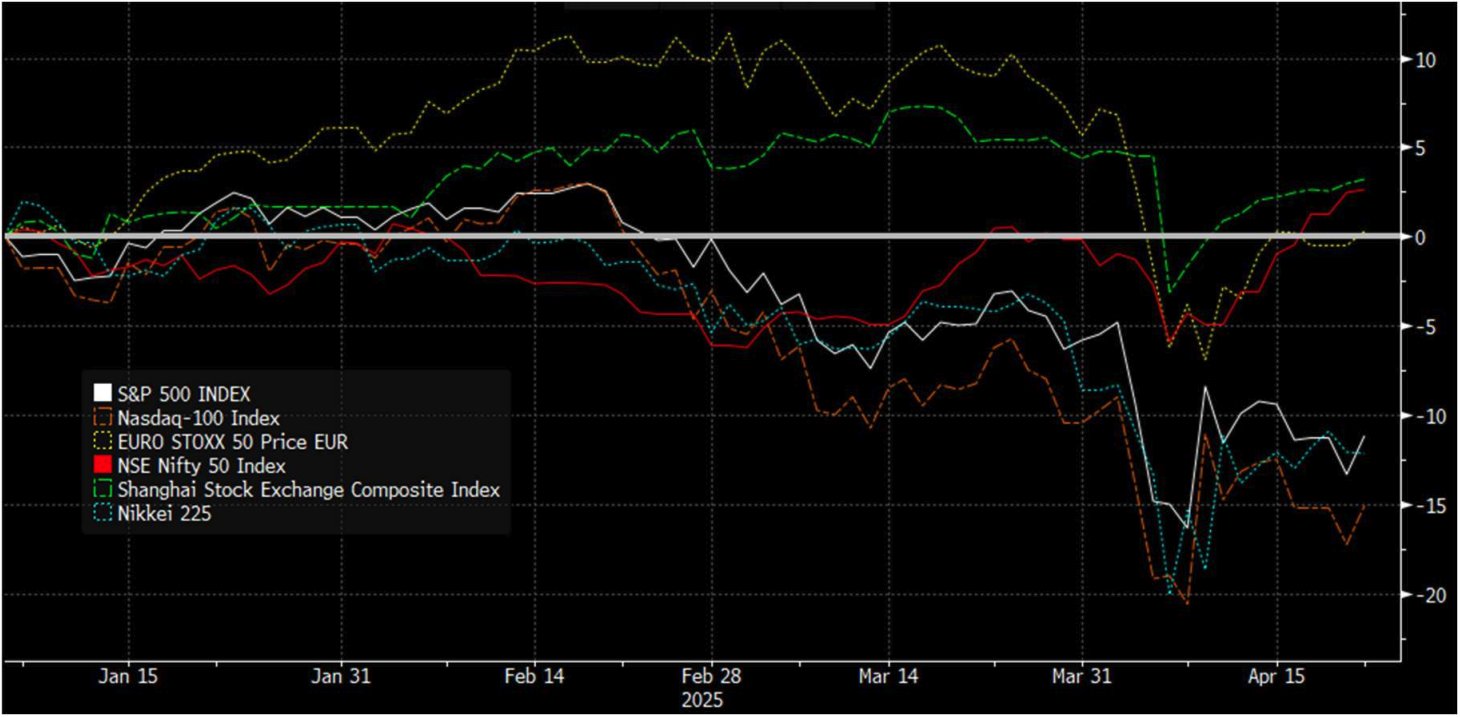

As the new trade barriers imposed by the Trump administra on shake Wall Street and global markets, China is moun ng a counter-offensive on a completely different front: that of a more discreet, yet equally powerful, economic war. Through a series of targeted ac ons, Beijing is leveraging its strategic tools — from technology to currency, including cri cal resources and the bond market — to weaken its

adversary without direct confronta on.

Since his return to the presidency, Donald Trump has reignited the trade confronta on with Beijing by imposing massive tariffs—up to 145% on Chinese goods, compared to 10% for other countries. The objec ve is clear: to break the United States’ dependence on China and restore a domes c industrial base. However, this aggressive policy strikes at the heart of China’s economic model, which is built on a trade surplus ($1 trillion in 2024) and an industrial power accoun ng for nearly 30% of global production. Rather than responding with brute force, China is deploying a mul -pronged strategy: technological, monetary, geopolitical, and financial.

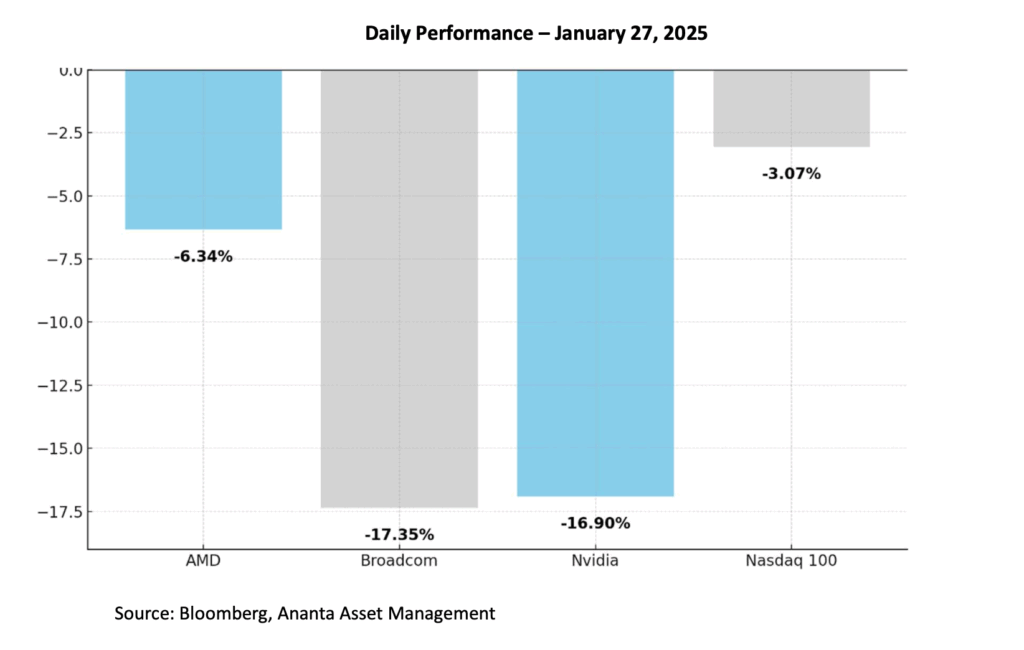

Technology: The Launch of DeepSeek

On January 20, 2025, the day of Trump’s inaugura on, Beijing unveiled DeepSeek, a private company specializing in artificial intelligence. Designed to rival GPT-4 while being less energy-intensive, this tool represents a clear assertion of China’s technological independence, despite U.S. restrictions on semiconductors. A measured yet symbolically powerful response that led to a drop in major U.S. tech stocks in the same sector just days later.

Strategic resources: The threat of rare Earths

Another tool of pressure: rare earths, essential for the manufacturing of numerous technological and military products. In April, China suspended the export of seven cri cal rare earths, such as terbium and dysprosium, which are used in radar systems and American military equipment. With over 80% of global production under Chinese control, this lever could significantly slow down the Western industry.

Exchange rate: The Yuan as a tool of influence

The yuan has depreciated by 1.3% since the beginning of April, reaching 7.35 CNY to the dollar. Officially, there has been no manipula on. However, in reality, Beijing subtly adjusts its daily reference rate, allowing the currency to weaken in order to boost exports while counteracting the effects of U.S. protectionist policies. A “clean” devaluation, without causing panic. Below is the chart comparing major currencies against the U.S. dollar. The yuan is highlighted in yellow, as the only currency to have depreciated against the dollar.

U.S. Bonds: The pressure on debt

The real shockwave came from the bond market: the 10-year Treasury yield jumped from 3.8% to 4.5% in just three days, as the United States prepares to refinance nearly $10 trillion in debt. Some sources men on massive sales of U.S. securities by China through offshore accounts. With over $700 billion of U.S. debt in hand by January 2025, Beijing holds a silent but formidable weapon. Below are the debt holders as of January 2025.

Source: https:// cdata.treasury.gov/resource-center/data-chart-center/ c/Documents/slt_table5.html?utm_source

Beijing has also struck symbolically. Suspension of Boeing deliveries, censorship of certain Hollywood films, and viral campaigns on TikTok ridiculing the effects of American protectionism. A cultural and psychological war in the digital age, waged with formidable effectiveness.

“Chinese economy is not a pond, but an ocean” – Xi Jinping

Far from bold posturing and loud statements, China opts for a diffuse strategic response, but one that could be far more destructive in the long term. Rare earths, Treasury bonds, sovereign technology, and communication tactics: Beijing moves its pieces patiently, methodically. In this type of confronta on, it is not the loudest who wins, but the one who unbalances their opponent sustainably… without ever striking directly. However, the latest news suggests a potential trade agreement.